Company Drives Record Revenue of $962.1 Million; Provides Updated Financial Performance Guidance for 2017

SAN DIEGO, CA – February 9, 2017 – NuVasive, Inc. (NASDAQ: NUVA), a leading medical device company focused on transforming spine surgery with minimally disruptive, procedurally-integrated solutions, announced today financial results for the quarter and full year ended December 31, 2016. Key performance highlights included:

Fourth Quarter 2016 Highlights:

- Revenue increased 25.9% to $271.1 million, or 25.5% on a constant currency basis;

- GAAP operating profit margin of 11.1%; Non-GAAP operating profit margin up 90 basis points to 18.0%; and

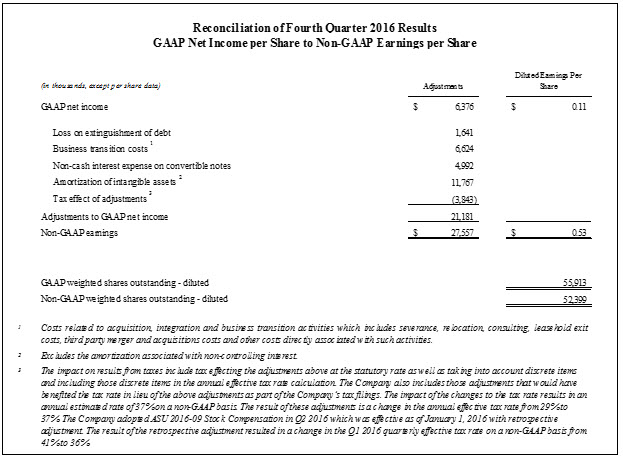

- GAAP diluted earnings per share of $0.11; Non-GAAP diluted earnings per share increase of 51.4% to $0.53.

Full Year 2016 Highlights:

- Revenue increased 18.6% to $962.1 million, or 18.4% on a constant currency basis;

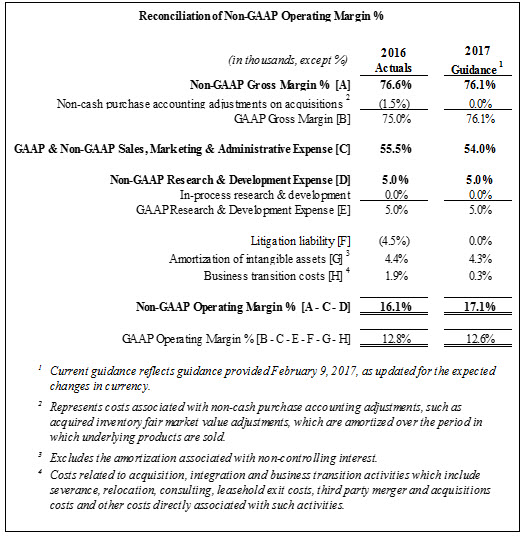

- GAAP operating profit margin of 12.8%; Non-GAAP operating profit margin up 70 basis points to 16.1%; and

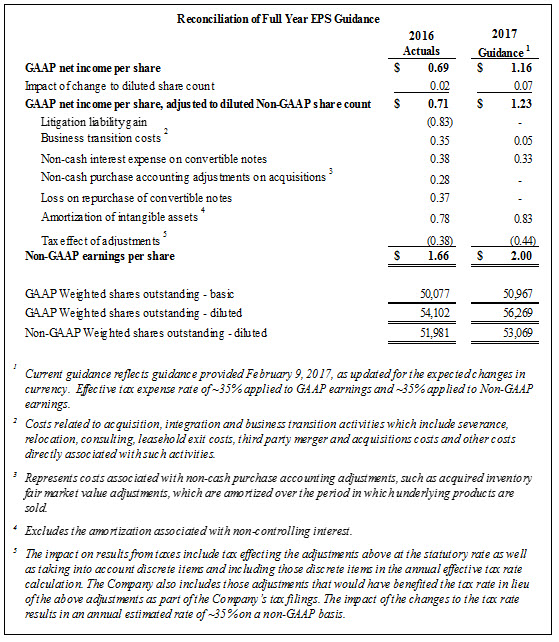

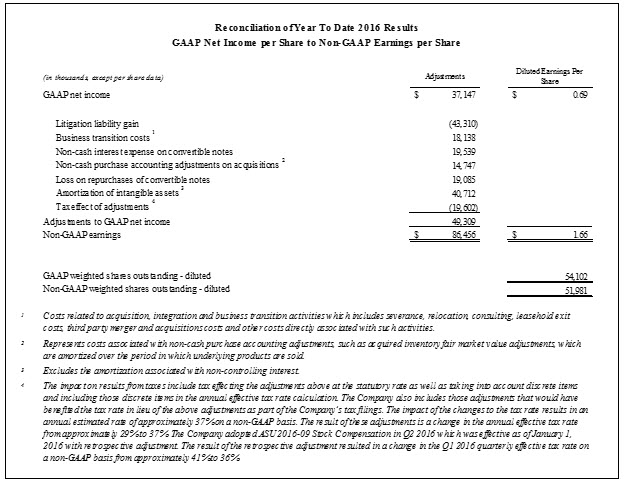

- GAAP diluted earnings per share of $0.69; Non-GAAP diluted earnings per share increase of 26.7% to $1.66.

“NuVasive delivered record fourth quarter results and exceeded expectations for the full year 2016. By all measures, the Company had a tremendous year executing against our market-share taking initiatives, delivering strong revenue growth, including a return to 20% year-over-year growth in our core International markets. We exceeded our profitability targets and integrated strategic acquisitions to augment our leadership in spine and deliver the substantial growth we forecasted as part of the deal models,” said Gregory T. Lucier, chairman and chief executive officer of NuVasive. “In 2017, we are committed to driving further market expansion, especially in the spine deformity area, while significantly increasing our in-sourced manufacturing capabilities and focusing on streamlining our operations to drive scale and profitability in our business.”

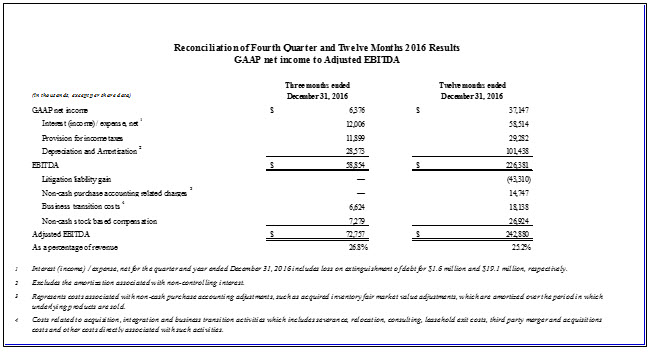

A full reconciliation of non-GAAP to GAAP measures can be found in the tables of this news release.

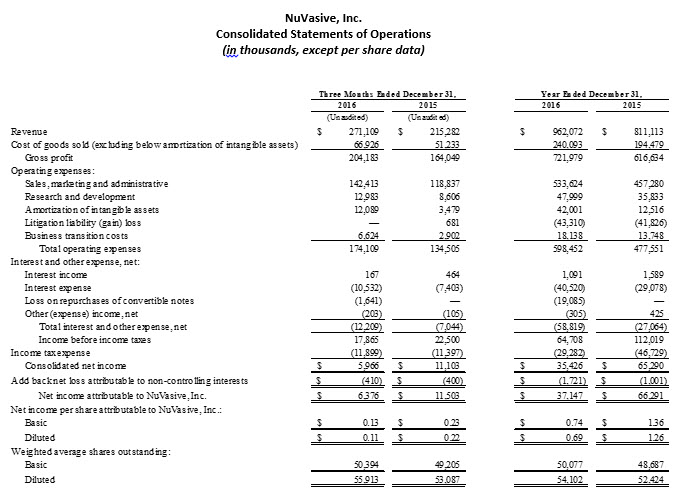

Fourth Quarter 2016 Results

NuVasive reported fourth quarter 2016 total revenue of $271.1 million, a 25.9% increase compared to $215.3 million for the fourth quarter 2015. On a constant currency basis, fourth quarter 2016 total revenue increased 25.5% compared to the same period last year.

Gross profit for the fourth quarter 2016 was $204.2 million on a GAAP and non-GAAP basis, while GAAP and non-GAAP gross margin was 75.3%. These results compared to gross profit of $164.0 million on a GAAP and non-GAAP basis, and GAAP and non-GAAP gross margin of 76.2% for the fourth quarter 2015. Total GAAP and non-GAAP operating expenses for the fourth quarter 2016 were $174.1 million and $155.4 million, respectively. These results compared to GAAP and non-GAAP operating expenses of $134.5 million and $127.3 million, respectively, for the fourth quarter 2015.

The Company reported a GAAP net income of $6.4 million, or $0.11 per share, for the fourth quarter 2016 compared to a GAAP net income of $11.5 million, or $0.22 per share, for the fourth quarter 2015. On a non-GAAP basis, the Company reported net income of $27.6 million, or $0.53 per share, for the fourth quarter 2016 compared to net income of $18.0 million, or $0.35 per share, for the fourth quarter 2015.

Full Year 2016 Results

NuVasive reported full year 2016 total revenue of $962.1 million, an 18.6% increase compared to $811.1 million for the full year 2015. On a constant currency basis, full year 2016 total revenue increased 18.4% compared to the same period last year.

Total GAAP and non-GAAP gross profit for the full year 2016 was $722.0 million and $736.7 million, respectively, while GAAP and non-GAAP gross margin of 75.0% and 76.6%, respectively. These results compared to gross profit of $616.6 million on a GAAP and non-GAAP basis and a GAAP and non-GAAP gross margin of 76.0% for the full year 2015. Total GAAP and non-GAAP operating expenses for the full year 2016 were $598.5 million and $581.6 million, respectively. These results compared to $477.6 million and $492.0 million, respectively, for the full year 2015.

The Company reported a GAAP net income of $37.1 million, or $0.69 per share, for the full year 2016 compared to a GAAP net income of $66.3 million, or $1.26 per share, for the full year 2015. On a non-GAAP basis, the Company reported net income of $86.5 million, or $1.66 per share, for the full year 2016 compared to net income of $66.9 million, or $1.31 per share, for the full year 2015.

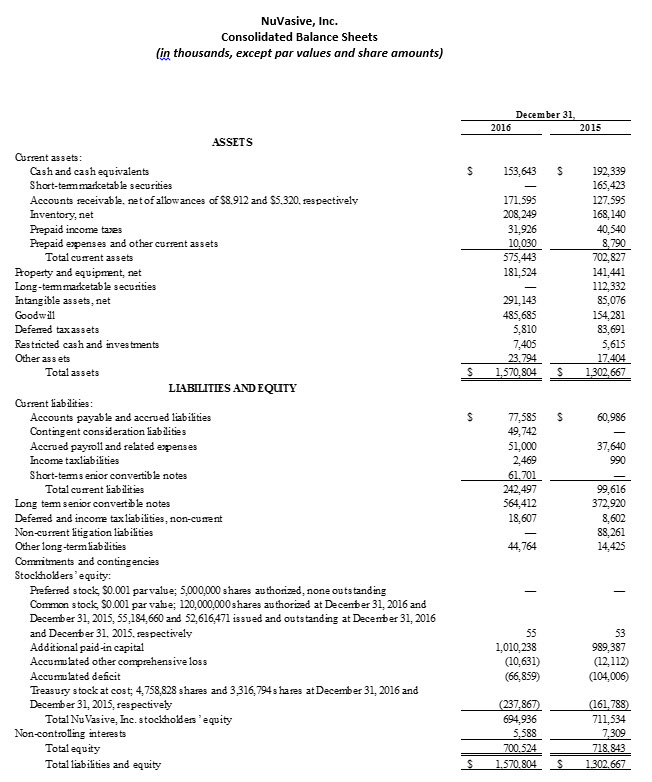

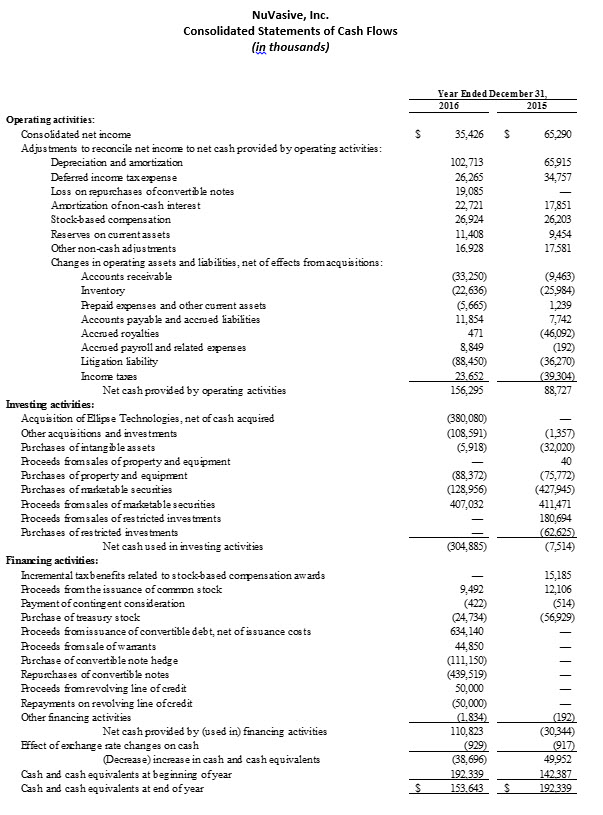

Cash, cash equivalents and short and long-term marketable securities were approximately $153.6 million at December 31, 2016.

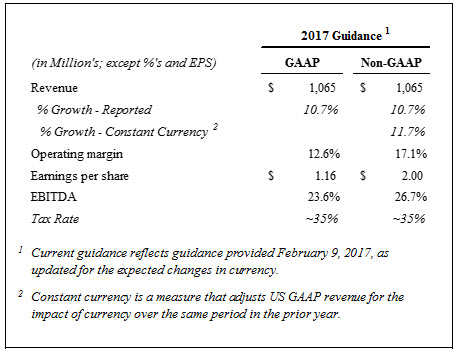

Annual Financial Guidance for 2017

The Company provided the following updated projections to its full year 2017 guidance:

- Revenue of $1.065 billion, which includes approximately $10 million in year-over-year currency headwinds, and reflects 10.7% growth on a reported basis and 11.7% growth on a constant currency basis compared to revenue of $962.1 million for 2016;

- Non-GAAP diluted earnings per share of $2.00, an increase of 20% compared to non-GAAP diluted earnings per share of $1.66 for 2016;

- Non-GAAP operating profit margin of 17.1%, an increase of 100 basis points compared to 16.1% for 2016; and

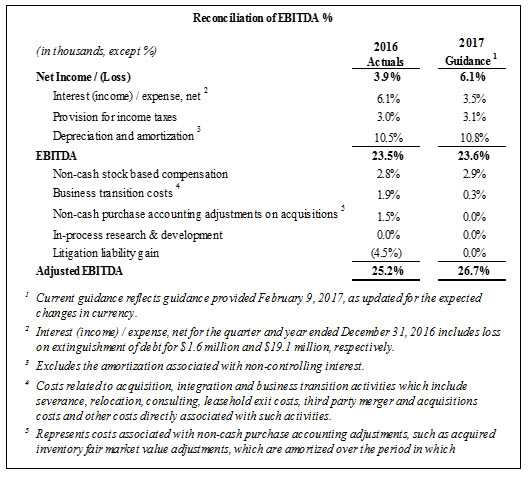

- Adjusted EBITDA margin of 26.7%, an increase of 150 basis points compared to 25.2% for 2016.

Supplementary Financial Information

For additional financial detail, please visit the Investor Relations section of the Company’s website at www.nuvasive.com to access Supplementary Financial Information.

Reconciliation of Non-GAAP Information

Management uses certain non-GAAP financial measures such as non-GAAP earnings per share, non-GAAP net income, non-GAAP operating expenses and non-GAAP operating profit margin, which exclude amortization of intangible assets, leasehold related charges, integration related expenses associated with acquired businesses, one-time restructuring and acquisition related items, CEO transition related costs, certain litigation charges and non-cash interest expense (excluding debt issuance cost) and or losses on convertible notes. Management also uses certain non-GAAP measures which are intended to exclude the impact of foreign exchange currency fluctuations. The measure constant currency is the use of an exchange rate that eliminates fluctuations when calculating financial performance numbers.

The Company also uses measures such as free cash flow, which represents cash flow from operations less cash used in the acquisition and disposition of capital. Additionally, the Company uses an adjusted EBITDA measure which represents earnings before interest, taxes, depreciation and amortization and excludes the impact of stock-based compensation, leasehold related charges, integration related expenses associated with acquired businesses, CEO transition related costs, certain litigation liabilities, acquisition related items and other significant one-time items. Management calculates the non-GAAP financial measures provided in this earnings release excluding these costs and uses these non-GAAP financial measures to enable it to further and more consistently analyze the period-to-period financial performance of its core business operations. Management believes that providing investors with these non-GAAP measures gives them additional information to enable them to assess, in the same way management assesses, the Company’s current and future continuing operations. These non-GAAP measures are not in accordance with, or an alternative for, GAAP, and may be different from non-GAAP measures used by other companies. Set forth below are reconciliations of the non-GAAP financial measures to the comparable GAAP financial measure.

Investor Conference Call

The Company will hold a conference call today at 4:30 p.m. ET / 1:30 p.m. PT to discuss the results of its fourth quarter and full year 2016 financial performance. The dial-in numbers are 1-877-407-9039 for domestic callers and 1-201-689-8470 for international callers. A live webcast of the conference call will be available online from the Investor Relations page of the Company’s website at www.nuvasive.com.

After the live webcast, the call will remain available on NuVasive’s website through March 9, 2017. In addition, a telephone replay of the call will be available until February 16, 2017. The replay dial-in numbers are 1-844-512-2921 for domestic callers and 1-412-317-6671 for international callers. Please use pin number: 13652783.

About NuVasive

NuVasive, Inc. (NASDAQ: NUVA) is a world leader in minimally invasive, procedurally-integrated spine solutions. From complex spinal deformity to degenerative spinal conditions, NuVasive is transforming spine surgery with innovative technologies designed to deliver reproducible and clinically proven surgical outcomes. NuVasive’s highly differentiated, procedurally-integrated solutions include access instruments, implantable hardware and software systems for surgical planning and reconciliation technology that centers on achieving the global alignment of the spine. With $962 million in revenues (2016), NuVasive has an approximate 2,300 person workforce in more than 40 countries around the world. For more information, please visit www.nuvasive.com.

Forward-Looking Statements

NuVasive cautions you that statements included in this news release or made on the investor conference call referenced herein that are not a description of historical facts are forward-looking statements that involve risks, uncertainties, assumptions and other factors which, if they do not materialize or prove correct, could cause NuVasive’s results to differ materially from historical results or those expressed or implied by such forward-looking statements. In addition, this news release contains selected financial results from the fourth quarter and full year 2016, as well as projections for 2017 financial guidance and longer-term financial performance goals. The Company’s results for the fourth quarter and full year 2016 are prior to the completion of review and audit procedures by the Company’s external auditors and are subject to adjustment. In addition, the Company’s projections for 2017 financial guidance and longer-term financial performance goals represent initial estimates, and are subject to the risk of being inaccurate because of the preliminary nature of the forecasts, the risk of further adjustment, or unanticipated difficulty in selling products or generating expected profitability. The potential risks and uncertainties which contribute to the uncertain nature of these statements include, among others, risks associated with acceptance of the Company’s surgical products and procedures by spine surgeons, spine surgeons, development and acceptance of new products or product enhancements, clinical and statistical verification of the benefits achieved via the use of NuVasive’s products (including the iGA™ platform), the Company’s ability to effectually manage inventory as it continues to release new products, its ability to recruit and retain management and key personnel, and the other risks and uncertainties more fully described in the Company’s news releases and periodic filings with the Securities and Exchange Commission. NuVasive’s public filings with the Securities and Exchange Commission are available at www.sec.gov. NuVasive assumes no obligation to update any forward-looking statement to reflect events or circumstances arising after the date on which it was made.