SAN DIEGO, CA – Oct. 25, 2016 – NuVasive, Inc. (Nasdaq: NUVA), a leading medical device company focused on transforming spine surgery with minimally disruptive, procedurally-integrated solutions, announced today financial results for the quarter ended September 30, 2016.

Third Quarter 2016 Highlights

- Revenue increased 19.5% to $239.6 million, or 18.9% on a constant currency basis

- GAAP operating profit margin of 8.8%; Non-GAAP operating profit margin of 16.1%

- GAAP diluted earnings per share of $0.07; Non-GAAP diluted earnings per share up 14.3% from prior year to $0.40

“Our results for the third quarter reflect continued strength in procedural volumes across the United States, as well as strong performances in our European and Australian markets,” said Gregory T. Lucier, NuVasive’s chairman and chief executive officer. “While our revenue results for the quarter were lower than our expectations due to capital and stocking orders in the United States that did not come through late in the quarter as planned, we believe this minor disruption is temporary. During the quarter, we continued to experience positive trends, including domestic procedural volumes in line with prior quarters and the conversion of surgeons at an increasingly faster pace, signaling stable market trends and competitive dynamics that favor our innovation and spine-only focused strategy.

“As anticipated, our results were also impacted by our dilator being off the market in Japan for a large portion of the quarter, which resulted in lower XLIF revenues. If XLIF procedures in Japan had been performed at their normal pace, the underlying revenue growth rate of our core business would have been in the mid-to-high single digits. We have resubmitted our dilator for approval with the Japanese Ministry of Health, and to be prudent, we have updated our financial guidance to reflect the removal of XLIF revenues in Japan for the fourth quarter.

Lucier continued, “Our intense focus on operational excellence is paying off as we delivered profitability and earnings that were significantly higher than our internal expectations, while continuing to invest in a broader innovation agenda and our new manufacturing facility in Ohio to drive long-term shareholder value creation. Based on these dynamics, we are reiterating our full year 2016 financial guidance in line with prior expectations, with the exception of revenue.”

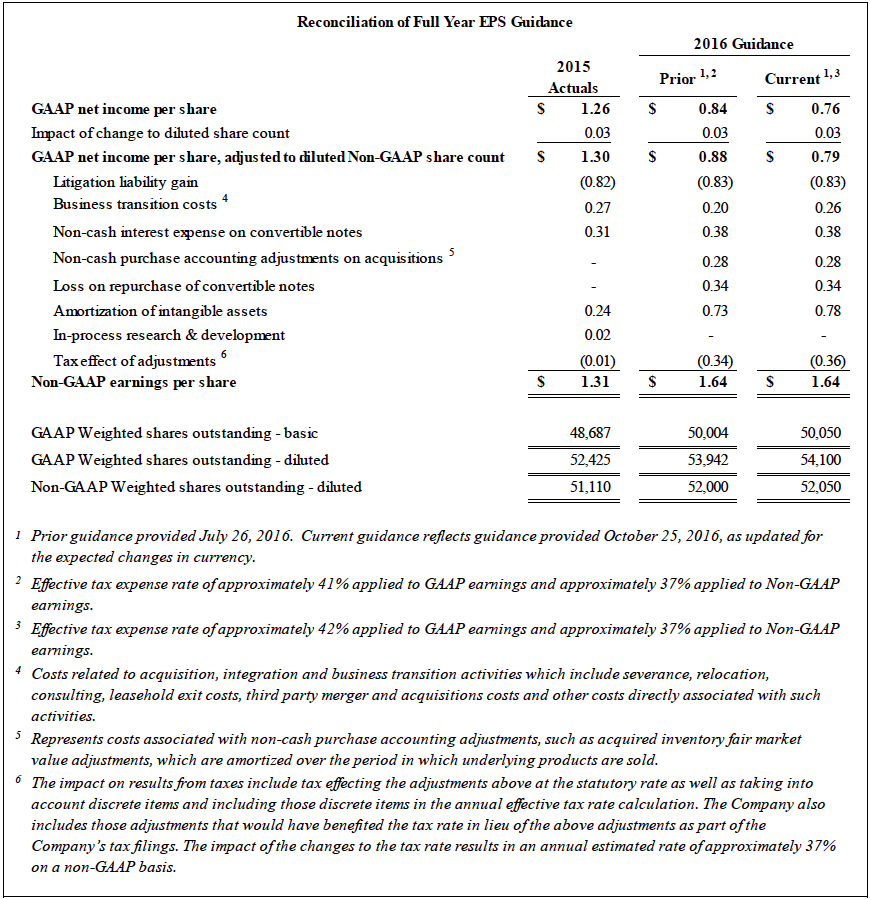

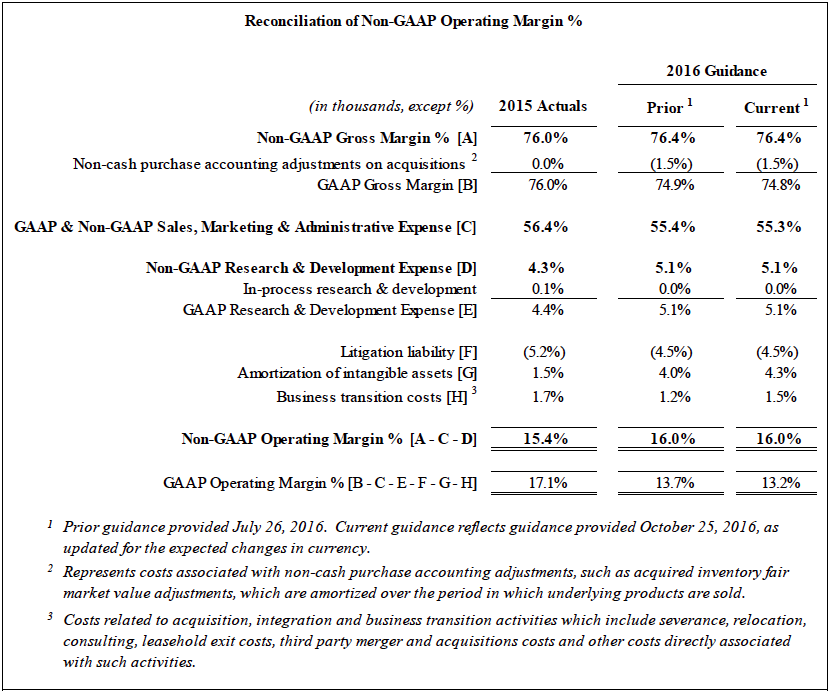

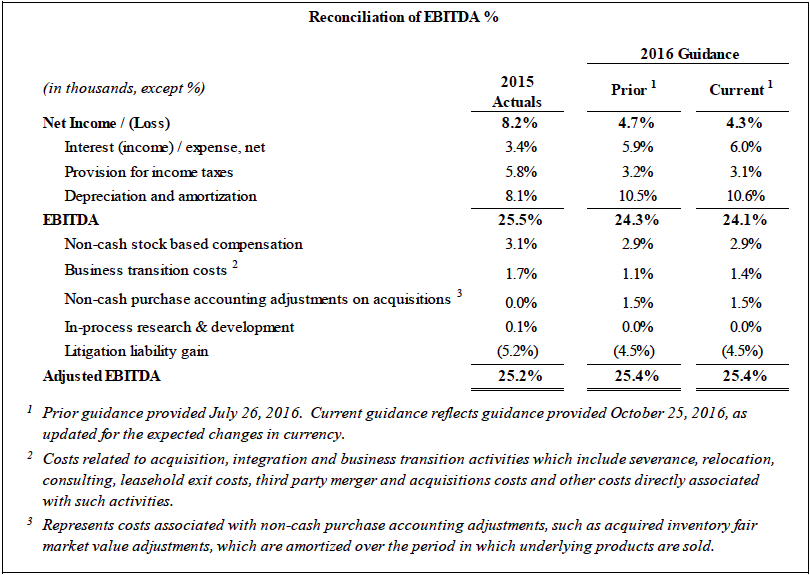

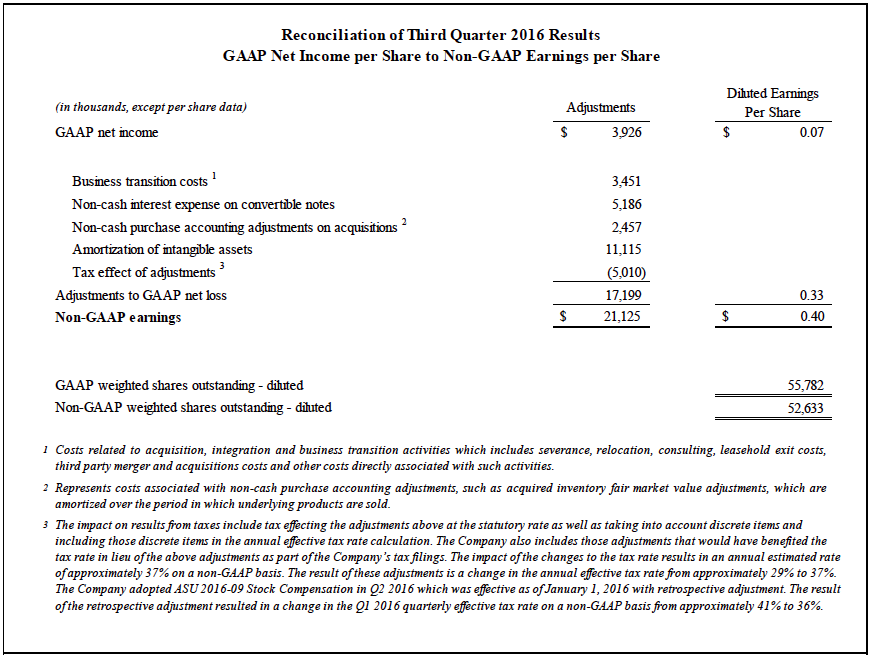

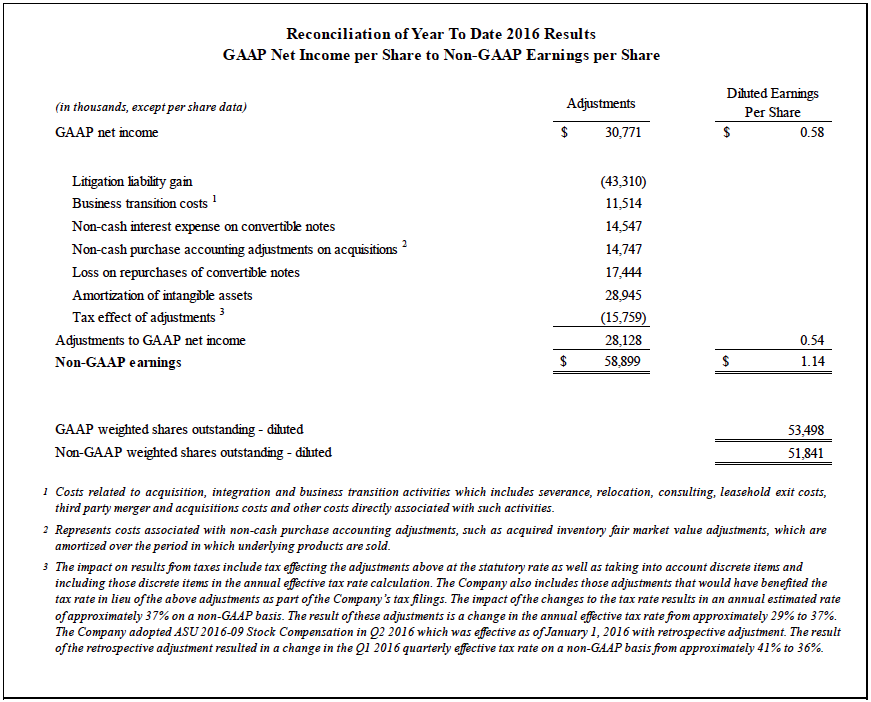

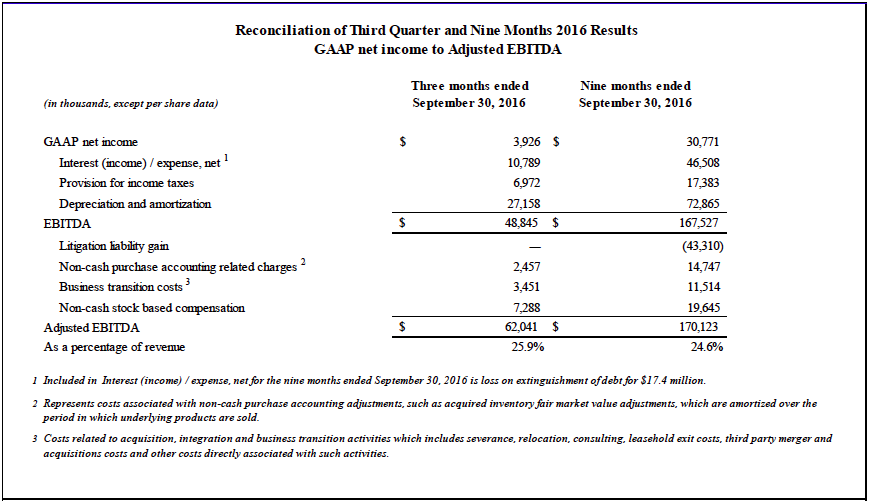

A full reconciliation of GAAP to non-GAAP measures can be found in the tables of this news release.

Third Quarter 2016 Results

NuVasive’s financial results for the third quarter 2016 are inclusive of results from Ellipse Technologies, Inc. Mega Surgical and Biotronic NeuroNetwork, as these previously disclosed acquisitions were completed earlier in the year. Ellipse Technologies now operates as the renamed division NuVasive Specialized

Orthopedics (NSO). Biotronic NeuroNetwork now operates alongside the Company’s existing Impulse Monitoring business under the renamed division NuVasive Clinical Services (NCS).

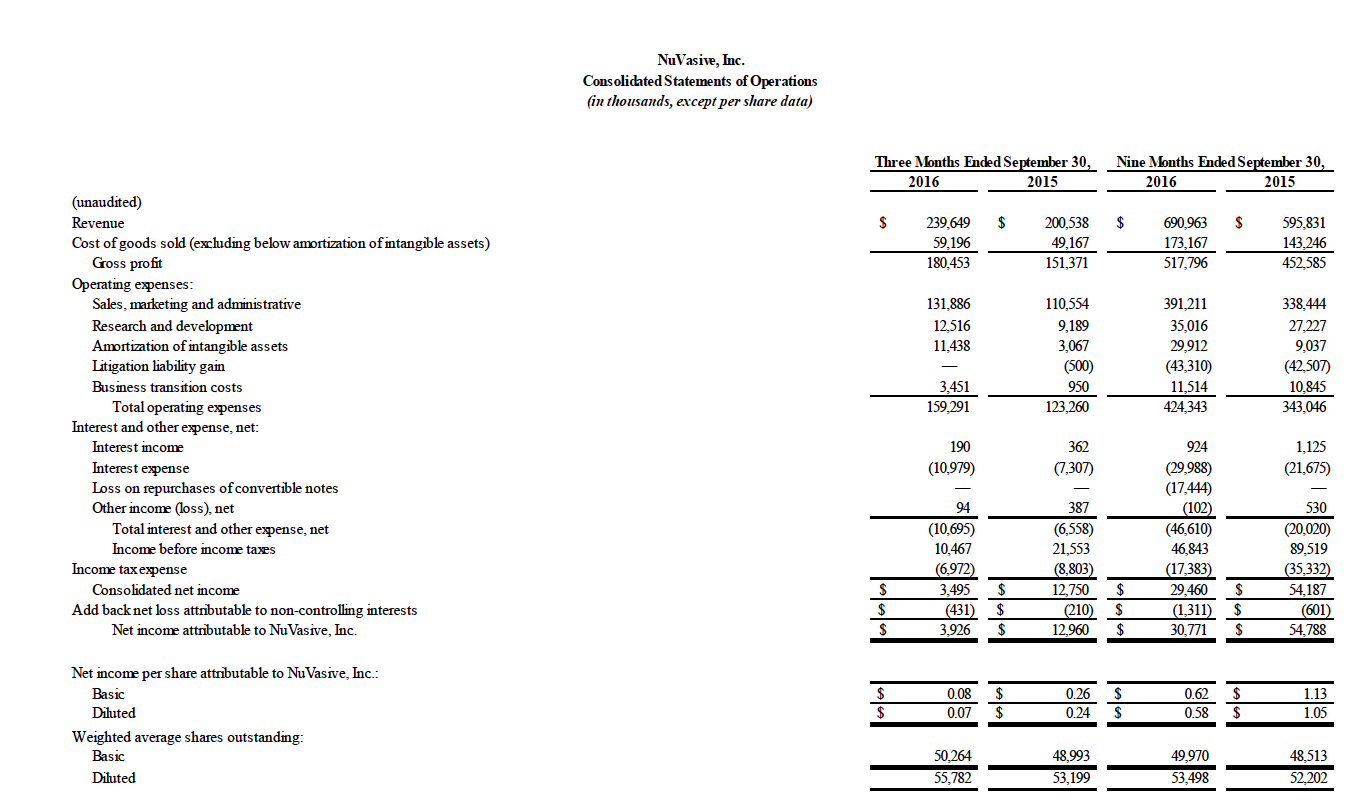

NuVasive reported third quarter 2016 total revenue of $239.6 million, a 19.5% increase compared to $200.5 million for the third quarter 2015. On a constant currency basis, third quarter 2016 total revenue increased 18.9% compared to the same period last year.

For the third quarter 2016, GAAP and non-GAAP gross profit was $180.5 million and $182.9 million, respectively, while GAAP and non-GAAP gross margin was 75.3% and 76.3%, respectively. These results compared to GAAP and non-GAAP gross profit of $151.4 million and GAAP and non-GAAP gross margin of 75.5% for the third quarter 2015. Total GAAP and non-GAAP operating expenses were $159.3 million and $144.4 million, respectively, for the third quarter of 2016. These results compared to GAAP and non-GAAP operating expenses of $123.3 million and $118.7 million, respectively, for the third quarter 2015.

NuVasive reported a GAAP net income of $3.9 million, or $0.07 per diluted share, for the third quarter 2016 compared to $13.0 million, or $0.24 per diluted share, for the third quarter 2015.

On a non-GAAP basis, the Company reported net income of $21.1 million, or $0.40 per diluted share for the third quarter 2016 compared to $18.1 million, or $0.35 per diluted share, for the third quarter 2015.

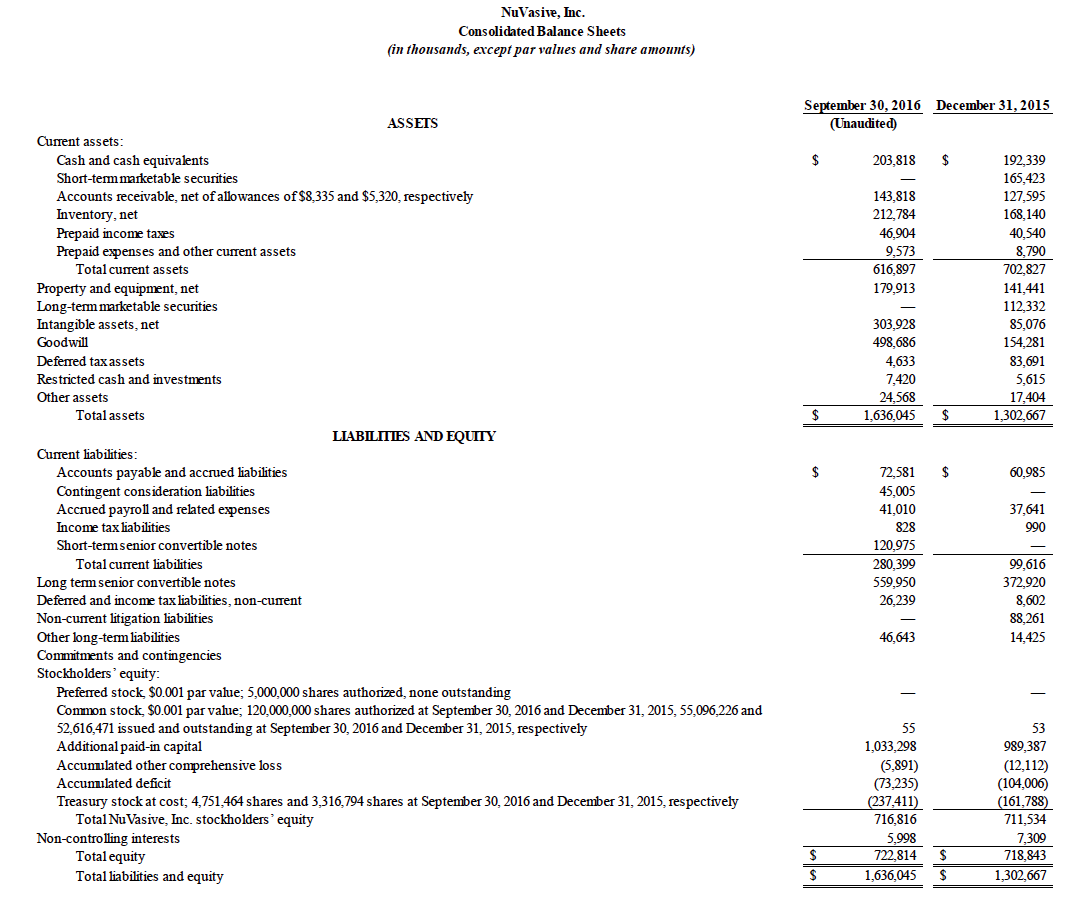

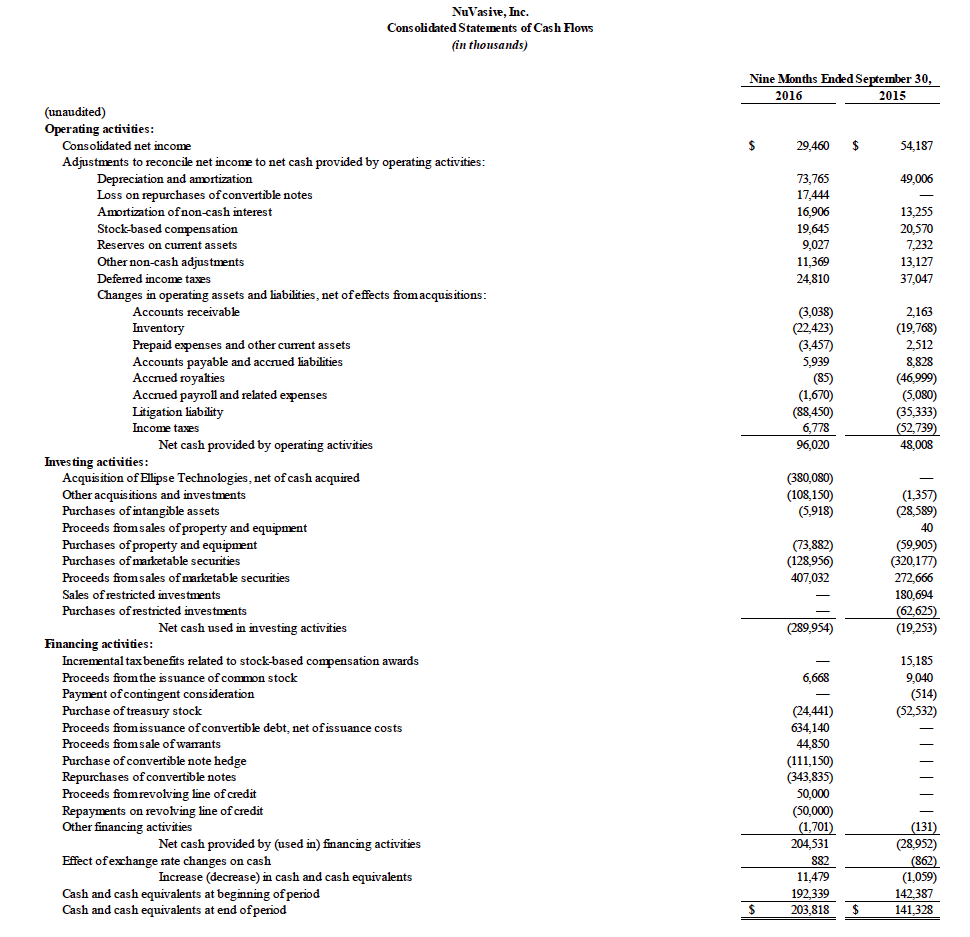

Cash, cash equivalents and short and long-term marketable securities were approximately $204 million at September 30, 2016.

Updated Guidance for 2016

The Company reiterated full year 2016 financial guidance in line with prior expectations, with the exception of revenue. The Company expects full year 2016 revenue to be lower than prior expectations based on the Company’s third quarter 2016 revenue results and the Company’s revised forecast for fourth quarter 2016 revenue in Japan.

- Revenue of approximately $952.0 million for 2016, which includes a $1 million benefit from currency or approximately 17.4% growth compared to revenue of $811.1 million for 2015; versus a prior expectation of $962.0 million for 2016;

- Non-GAAP diluted earnings per share of approximately $1.64, an increase of approximately 25% and in line with the prior expectation of $1.64, compared to non-GAAP diluted earnings per share of $1.31 for 2015;

- Non-GAAP operating profit margin of approximately 16.0%, an increase of 60 basis points compared to 15.4% for 2015; in line with the prior expectation of approximately 16.0% for 2016;

- Adjusted EBITDA margin of approximately 25.4% for 2016; in line with the prior expectation of approximately 25.4% for 2016, compared to 25.2% for 2015; and

- Non-GAAP effective tax expense rate of approximately 37%; in line with the prior expectation of approximately 37% for 2016.

Supplementary Financial Information

For additional financial detail, please visit the Investor Relations section at www.nuvasive.com to access Supplementary Financial Information.

Reconciliation of Non-GAAP Information

Management uses certain non-GAAP financial measures such as non-GAAP earnings per share, non-GAAP net income, non-GAAP operating expenses and non-GAAP operating profit margin, which exclude amortization of intangible assets, non-cash purchase accounting adjustments on acquisitions, business transition costs, CEO transition related costs, certain litigation charges, significant one-time items, non-cash interest expense and/or losses on repurchase of convertible notes, and the impact from taxes related to these items, including those taxes that would have occurred in lieu of these items. Management also uses certain non-GAAP measures which are intended to exclude the impact of foreign exchange currency fluctuations. The measure constant currency is the use of an exchange rate that eliminates fluctuations when calculating financial performance numbers.

The Company also uses measures such as free cash flow, which represents cash flow from operations less cash used in the acquisition and disposition of capital. Additionally, the Company uses an adjusted EBITDA measure which represents earnings before interest, taxes, depreciation and amortization and excludes the impact of stock-based compensation, non-cash purchase accounting adjustments on acquisition, business transition costs, CEO transition related costs, certain litigation charges, and other significant one-time items. Management calculates the non-GAAP financial measures provided in this earnings release excluding these costs and uses these non-GAAP financial measures to enable it to further and more consistently analyze the period-to-period financial performance of its core business operations. Management believes that providing investors with these non-GAAP measures gives them additional information to enable them to assess, in the same way management assesses, the Company’s current and future continuing operations. These non-GAAP measures are not in accordance with, or an alternative for, GAAP, and may be different from non-GAAP measures used by other companies. Set forth below are reconciliations of the non-GAAP financial measures to the comparable GAAP financial measure.

Investor Conference Call

NuVasive will hold a conference call today at 5:30 p.m. ET / 2:30 p.m. PT to discuss the results of its financial performance for the third quarter 2016. The dial-in numbers are 1-877-407-9039 for domestic callers and 1-201-689-8470 for international callers. A live webcast of the conference call will be available online from the Investor Relations page of the Company’s website at www.nuvasive.com. After the live webcast, the call will remain available on NuVasive’s website through November 28, 2016. In addition, a telephone replay of the call will be available until November 2, 2016. The replay dial-in numbers are 1-844- 512-2921 for domestic callers and 1-412-317-6671 for international callers. Please use pin number: 13646026.

About NuVasive

NuVasive, Inc. (NASDAQ: NUVA) is a world leader in minimally invasive, procedurally-integrated spine solutions. From complex spinal deformity to degenerative spinal conditions, NuVasive is transforming spine surgery with innovative technologies designed to deliver reproducible and clinically proven surgical outcomes. NuVasive’s highly differentiated, procedurally-integrated solutions include access instruments, implantable hardware and software systems for surgical planning and reconciliation technology that centers on achieving the global alignment of the spine. With $811 million in revenues (2015), NuVasive has an approximate 2,200 person workforce in more than 40 countries around the world. For more information, please visit www.nuvasive.com.

NuVasive cautions you that statements included in this news release or made on the investor conference call referenced herein that are not a description of historical facts are forward-looking statements that involve risks, uncertainties, assumptions and other factors which, if they do not materialize or prove correct, could cause NuVasive’s results to differ materially from historical results or those expressed or implied by such forward-looking statements. In addition, this news release contains selected financial results from the third quarter 2016, as well as projections for 2016 financial guidance and longer-term financial performance goals. The Company’s projections for 2016 financial guidance and longer-term financial performance goals represent current estimates, including initial estimates of the potential benefits, synergies and cost savings associated with acquisitions, which are subject to the risk of being inaccurate because of the preliminary nature of the forecasts, the risk of further adjustment, or unanticipated difficulty in selling products or generating expected profitability. The potential risks and uncertainties that could cause actual growth and results to differ materially include, but are not limited to: the risk that NuVasive’s revenue or earnings projections may turn out to be inaccurate because of the preliminary nature of the forecasts; the risk of further adjustment to financial results or future financial expectations; unanticipated difficulty in selling products, generating revenue or producing expected profitability; the risk that acquisitions will not be integrated successfully or that the benefits and synergies from the acquisition may not be fully realized or may take longer to realize than expected; and those other risks and uncertainties more fully described in the Company’s news releases and periodic filings with the Securities and Exchange Commission. NuVasive’s public filings with the Securities and Exchange Commission are available at www.sec.gov. The forward-looking statements contained herein are based on the current expectations and assumptions of NuVasive and not on historical facts. NuVasive assumes no obligation to update any forward-looking statement to reflect events or circumstances arising after the date on which it was made.

Investor Contact:

Suzanne Hatcher

NuVasive, Inc.

1-858-458-2240

[email protected]

Media Contact

Michael Farrington

NuVasive, Inc.

1-858-909-1940

[email protected]